15 November 2021

Is it realistic to achieve 175 GW of renewable capacity by 2022? An IPP’s take

Authored by Parag Sharma – Founder and CEO at O2 Power Vinamra Singh – Manager, CEO Cell at O2 Power

- Posted at 03:55 AM in Renewable by Admin

- 0 Comment

- Likes

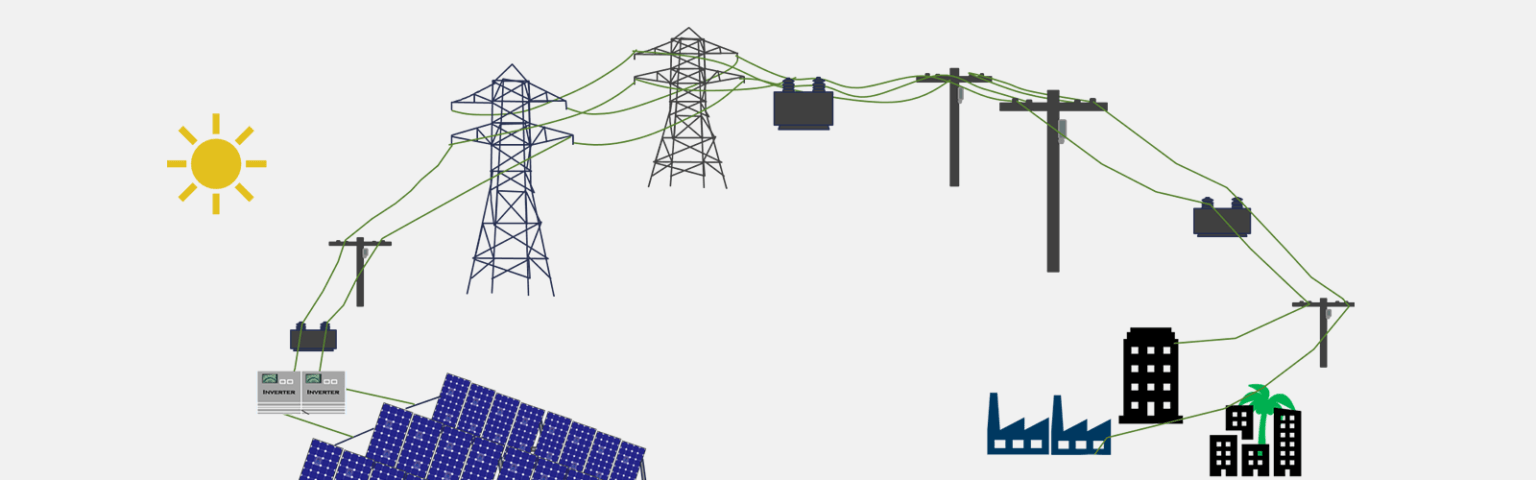

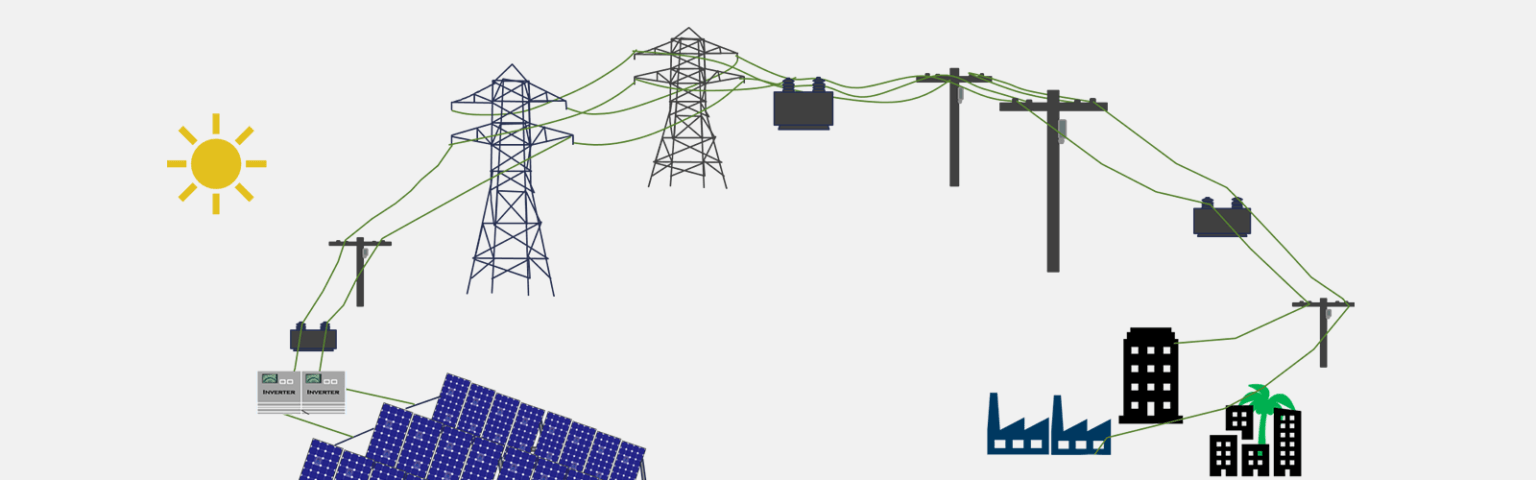

Government of India (GoI) has set a target of installing 175 GW of renewable energy capacity by the year 2022. This includes 100 GW from solar, 60 GW from wind, and over all 450 GW by 2030. If you ask me, these are some very ambitious targets.

We IPPs are all up for ambitious targets. After all, it is any day better to fail pursuing ambitious targets than achieve mediocre ones. However, 175 GW will require a complete system overhaul with collaboration from every stakeholder in the renewable energy industry to drive modifications and system improvements.

Track record so far

India started with 1 GW solar power capacity in 2010. Today, it has around 35 GW of solar power. We have also added about 25 GW of wind power capacity in this period.

Going forward, the sector requires rapid ramp-up to achieve the goal set out for the year 2022. This is aggressive but achievable, and subject to the government delivering:

- Policy stability

- Proactive bidding strategy

- Transparency and consistency

In the past, India has seen too many policy inconsistencies, change, centre-state conflicts, resulting in negative investor sentiments. These need to change — an ecosystem should be created which will enable free flow of capital, long term regulations and centre-state collaboration.

Further, capital requirement to achieve the 2022 target is close to $80 billion at today’s prices. This is a tall ask, and will need well thought through financing roadmap.

Steps required to achieve 175 GW

- Auction out the capacity as soon as possible. Additionally, auction out the associated infra like switchyards and transmission line. There have been constant delays in conducting the bids — with bids having extended for months, years in case of some complex bids. Bids that require coordination and collaboration amongst all the stakeholders is often found lacking thereby resulting in huge delays.

- For many already bid out capacities, there is a huge backlog in the signing of PPAs — greater than 20 GW of auctioned capacity is yet to find a PPA. In these uncertain times of forex rate fluctuation, varying equipment prices, waiting for PPAs to be signed becomes riskier by the day. This uncertainty can be resolved by taking firm annual commitments from discoms for purchase of power. As per the competitive bidding guidelines for conventional power plant, a demand-supply analysis is done by a discom and vetted by the regulator, before a bid is called. Although it might seem like a cumbersome task, done even once a year, it will help in avoiding unnecessary delays post a bid is called.

- The competitive price that discoms expect makes the risk-reward relationship highly skewed against developers. A number of bidding agencies, upon finding auction prices undesirable, resort to bid annulation. Government must restore the sanctity of auctions and should refrain from cancellations or postponement of bids.

- MNRE should come out with a bidding calendar providing month-wise target for bids. Ministry of Power (MoP) also needs to have a long-term de-commissioning plan for old thermal power plants, which will help discoms plan their power procurement. With clarity on auctions and certainty on the complete capacity bidding out, the real work starts — monitoring of ‘actual construction’ of the projects. An even more difficult phase, a definite push is required at the policy level to solve implementation related issues including solar park implementation issues, adoption and approval of tariff at respective regulatory commission, ever-changing policy / regulations and implementation of change in law.

- There is dearth of ISTS substations, with most ISTS substations and related infrastructure getting delayed thereby delaying the renewable plants construction. Land required for utility scale solar projects is getting exhausted; in case of wind, either the good wind potential sites don’t have a spare substation capacity in the vicinity or if the capacity is available, the wind potential is not good in that area. Add to this the uncertainty on ‘import-duty’ impacting the whole ecosystem, we find ourselves riding two boats simultaneously – trying to get the cheapest possible renewable energy cost while at the same time pushing domestic manufacturing which is at least 20-30% costlier than imports. This has a counter effect on the complete ecosystem.

Leave a comment